3 TSX Penny Stocks To Consider In November 2025

The Canadian market has been experiencing a period of adjustment, particularly as mega-cap tech companies shift towards more asset-heavy business models with significant investments in AI infrastructure. This evolving landscape underscores the importance of diversification and exploring areas beyond the usual large-cap technology sectors. Penny stocks, though considered a niche investment area today, still offer intriguing opportunities for growth, especially when backed by strong financial health and resilience.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$51.82M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.73 | CA$176.31M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.33 | CA$48.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.19 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$22.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.20 | CA$945.72M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.85 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.20 | CA$207.39M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$10.23M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: St-Georges Eco-Mining Corp. focuses on the acquisition, exploration, and development of mineral properties in Canada and Iceland, with a market cap of CA$17.18 million.

Operations: St-Georges Eco-Mining Corp. does not have any reported revenue segments.

Market Cap: CA$17.18M

St-Georges Eco-Mining Corp., with a market cap of CA$17.18 million, is pre-revenue and focuses on mineral exploration in Canada and Iceland. Despite its unprofitability, the company has reduced its debt to equity ratio significantly over five years, indicating improved financial health. Recent exploration at the Julie Project revealed promising new mineralized zones with platinum-group elements and high-grade iron, enhancing project potential. Additionally, advancements in lithium metallurgy through pilot plant initiatives suggest economic viability due to cost-efficient processes compared to traditional methods. However, short-term liabilities exceed assets, posing a financial challenge for sustained operations.

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kapa Gold Inc. focuses on the acquisition and exploration of mineral properties, with a market cap of CA$18.35 million.

Operations: Kapa Gold Inc. has not reported any revenue segments.

Market Cap: CA$18.35M

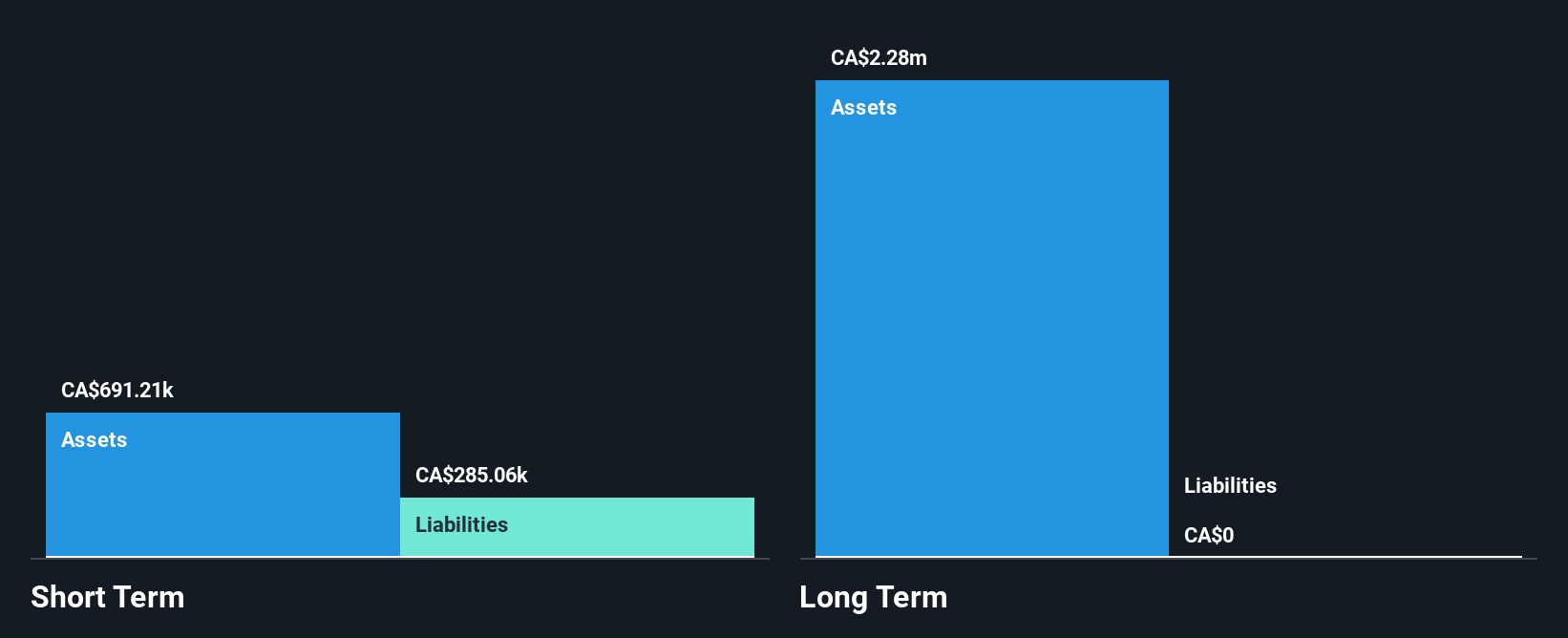

Kapa Gold Inc., with a market cap of CA$18.35 million, is pre-revenue and unprofitable but has reduced its losses by 10.8% annually over the past five years. The company maintains a stable financial position with no debt and short-term assets exceeding liabilities (CA$691.2K vs CA$285.1K). Despite having less than a year of cash runway, it remains undiluted over the past year, indicating shareholder stability. Recent earnings show slight improvement in net loss for the nine months ending September 2025 compared to last year. The board’s experience averages 3.5 years, although recent changes may impact strategic direction.

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Resouro Strategic Metals Inc. is an exploration stage company focused on acquiring and exploring mineral properties in Brazil, with a market cap of CA$22.22 million.

Operations: Resouro Strategic Metals Inc. has not reported any revenue segments as it is currently in the exploration stage.

Market Cap: CA$22.22M

Resouro Strategic Metals Inc., with a market cap of CA$22.22 million, is pre-revenue and currently in the exploration stage in Brazil. The company has no debt, and its short-term assets slightly exceed liabilities (CA$416.0K vs CA$415.2K). Despite a highly volatile share price recently, Resouro’s management team is experienced with an average tenure of three years. The company has improved its net loss for the recent quarter compared to last year and raised CA$3 million through private placements to bolster its cash position. However, it faces challenges with only one month of cash runway based on free cash flow estimates before additional capital was raised.

Key Takeaways

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com