High Growth Tech Stocks In Asia To Watch This September 2025

As global markets navigate a landscape marked by rate cut expectations and the ongoing AI boom, Asian tech stocks have captured investor attention with their potential for high growth. In this environment, a good stock often exhibits strong fundamentals and innovative capabilities, aligning well with broader market trends such as technological advancements and regional economic shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Fositek | 33.89% | 44.41% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.75% | 30.67% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.13% | 27.55% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★★

Overview: CARsgen Therapeutics Holdings Limited is an investment holding company focused on the discovery, development, and commercialization of CAR-T cell therapies for hematological malignancies, solid tumors, and autoimmune diseases in China with a market cap of HK$11.55 billion.

Operations: CARsgen Therapeutics Holdings Limited generates revenue primarily from its pharmaceuticals segment, reporting CN¥84.05 million. The company is involved in the development and commercialization of CAR-T cell therapies aimed at treating various diseases including hematological malignancies and solid tumors.

CARsgen Therapeutics Holdings has demonstrated a notable turnaround, with its recent half-year earnings showing a significant reduction in net loss from CNY 351.56 million to CNY 75.48 million and an eightfold increase in sales to CNY 50.96 million. This growth is propelled by the successful commercialization of CT053 in China, enhanced by favorable foreign exchange impacts and sharply reduced R&D expenses on key projects like CT053 and CT041. Moreover, the company’s strengthened intellectual property position following a decisive patent victory enhances its competitive edge in CAR-T therapies for solid tumors, setting a robust foundation for future revenue streams and market presence in biotech.

Simply Wall St Growth Rating: ★★★★★☆

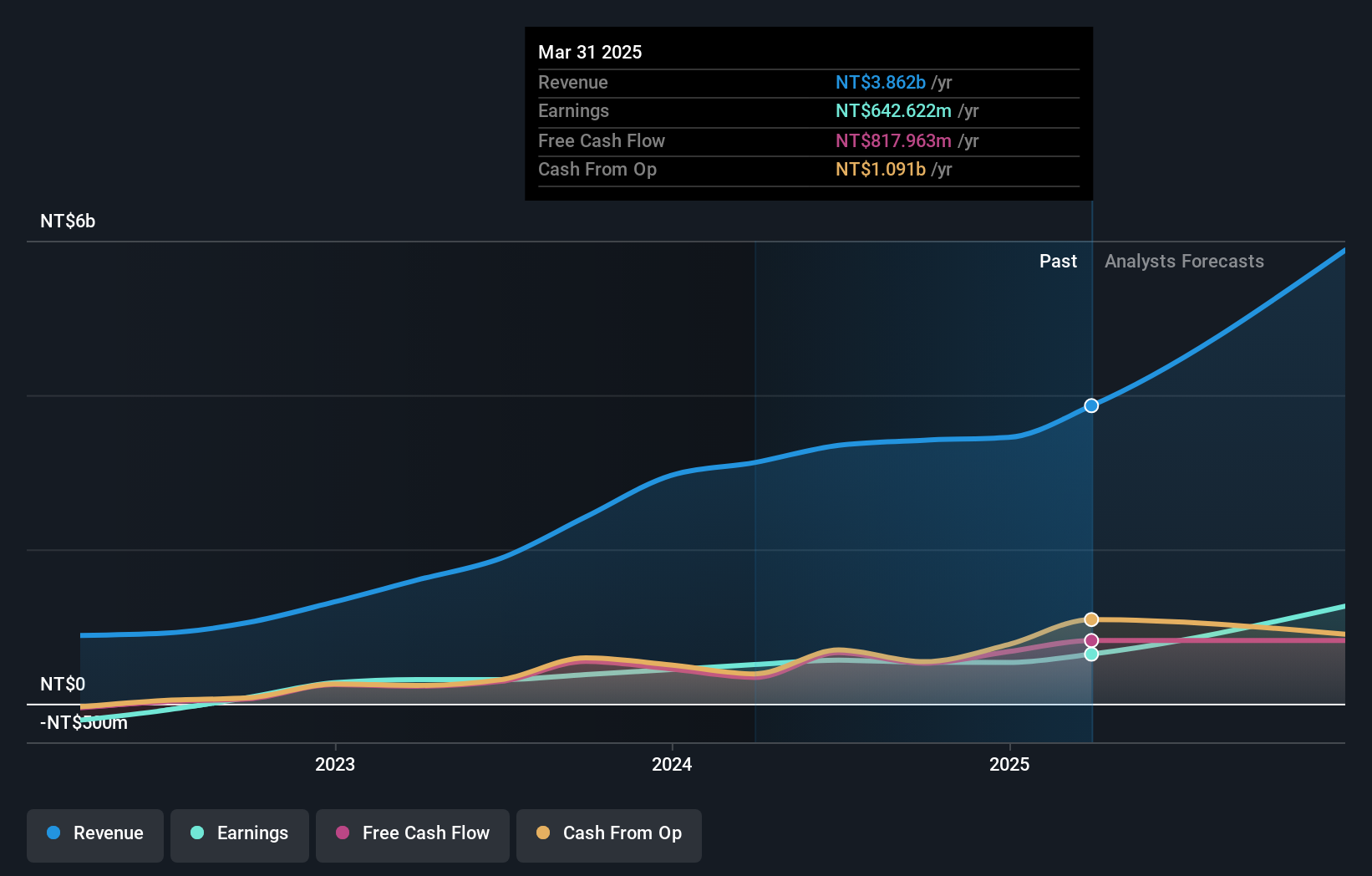

Overview: LuxNet Corporation, along with its subsidiaries, engages in the manufacturing, processing, and sale of electric and optical communication components in Taiwan with a market capitalization of NT$28.59 billion.

Operations: LuxNet focuses on the production and sale of optical communication system active components, generating revenue of NT$4.15 billion.

LuxNet, a rising contender in Asia’s tech scene, has shown robust growth with a 41.3% annual increase in revenue and earnings growth projected at 59.7% per year. This performance is underpinned by strategic R&D investments, which have notably escalated to TWD 500 million this year, enhancing their competitive edge in communications technology. Recent financial reports reveal a significant uptick in sales to TWD 2.15 billion over six months, up from TWD 1.46 billion the previous year, reflecting strong market demand and effective new product integrations post the recent amendments to its corporate bylaws. These figures suggest LuxNet is effectively capitalizing on industry trends towards advanced tech solutions, positioning it well for sustained future growth amidst fierce competition.

Simply Wall St Growth Rating: ★★★★☆☆

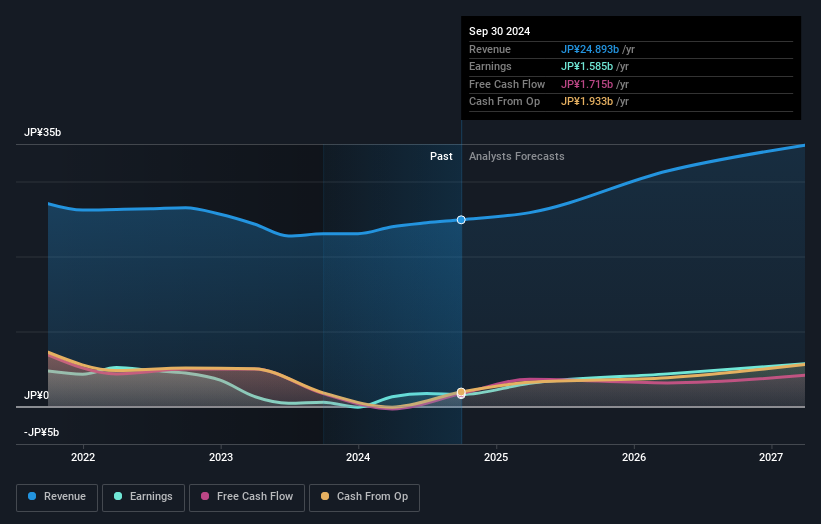

Overview: Akatsuki Inc. is a Japanese company involved in the game, comic, and other business sectors with a market capitalization of ¥41.73 billion.

Operations: The company’s primary revenue stream comes from its game segment, generating ¥19.34 billion, while the comic segment contributes ¥1.14 billion.

Akatsuki’s trajectory in the tech sector is marked by a notable annual revenue growth rate of 12.4%, outpacing Japan’s market average of 4.4%. This growth is coupled with an impressive forecast for earnings to surge by 51.4% annually. However, recent financials reveal a significant one-off gain of ¥551 million, which skews the true operational performance slightly. Despite this, the company maintains a positive free cash flow and an anticipated low return on equity of 8.6% in three years, suggesting cautious optimism for its financial health amidst aggressive expansion efforts in high-demand entertainment technologies.

Make It Happen

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Credit: Source link