Is It Too Late to Reassess Coeur Mining After a 200% Rally in 2025?

Trying to figure out what to do with Coeur Mining stock? You are not alone. After a remarkable run this year, the share price has skyrocketed by more than 200.8% year-to-date, easily outpacing market averages. Plenty of investors are asking whether it is time to hold, buy, or possibly even take profits. Just this past month, the stock delivered another strong 7.1% gain. However, the last week brought a sharp -11.4% pullback that has some wondering if a reassessment is underway.

So what is driving all this movement? A lot of the recent optimism seems tied to positive sentiment around precious metals and speculation about favorable industry trends. Over the past year, Coeur Mining’s performance has been nothing short of stellar, up 174.3% over twelve months, and a jaw-dropping 386.9% over three years. But those rapid gains have also led some market watchers to revisit whether the stock has run too far, too fast, especially as valuations come under the spotlight.

Right now, Coeur Mining registers a value score of 0 out of 6 according to traditional valuation checks, meaning it does not pass as undervalued in any of the main categories analysts use. That is a stark signal, but valuation is always about context and interpretation, not just numbers on a screen. Let’s break down those core valuation approaches and see what they really tell us. At the end, we will cover an even better way to think about a stock’s true value.

Coeur Mining scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coeur Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation model works by forecasting a company’s future cash flows and then discounting those amounts back to today’s value. This calculation helps estimate what a company is truly worth, based on the money it is expected to generate going forward.

For Coeur Mining, the current Free Cash Flow (FCF) sits at $41.79 million. Looking ahead, analysts estimate that by 2028, FCF will reach $395 million. Projections extending out another seven years (to 2035) show a range of $350 million to $919 million, depending on future performance and analyst expectations. These projections combine analyst estimates through 2028, followed by Simply Wall St’s own extrapolations for later years.

All cash flow numbers are in US Dollars. The DCF calculation uses these projected figures, discounting them appropriately back to the present day to determine what an investor should, in theory, be willing to pay for the business today.

The resulting estimated intrinsic value for Coeur Mining, as calculated by this DCF approach, is $11.19 per share. Compared to the stock’s current market price, this implies the shares are 66.7% overvalued based on future cash flow expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coeur Mining may be overvalued by 66.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Coeur Mining Price vs Earnings (P/E Ratio)

The price-to-earnings (P/E) ratio is widely used to value profitable companies because it directly compares a company’s share price to its per-share earnings. This makes it easy to see how much the market is willing to pay for each dollar of profit. The P/E ratio is especially useful for companies like Coeur Mining that have positive earnings, as it helps investors judge whether the stock price reflects reasonable growth expectations and business risks.

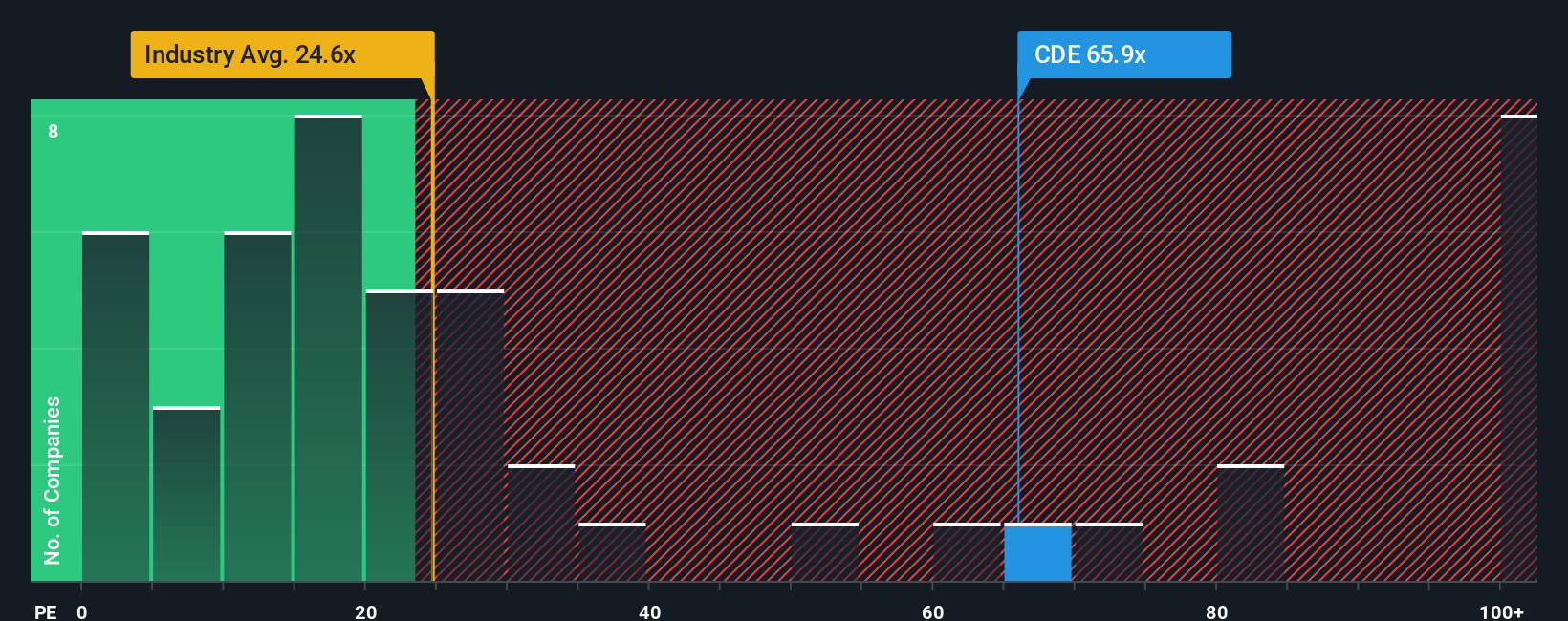

Growth prospects and risk factors play a big role in what constitutes a “normal” or “fair” P/E ratio for any business. Companies that are growing faster or are seen as less risky often trade at higher P/E multiples. Lower multiples can suggest limited growth, high risk, or simply undervaluation. For Coeur Mining, the current P/E ratio stands at 62.9x. This is significantly higher than the Metals and Mining industry average of 25.2x and the peer group average of 20.3x, signaling that investors are pricing in substantial future growth or lower risk compared to the broader sector.

Instead of just comparing with industry or peer averages, Simply Wall St offers a proprietary “Fair Ratio” that better accounts for factors like the company’s earnings growth, profit margins, market cap, risk profile, and unique sector. For Coeur Mining, the Fair Ratio is 52.7x. This means a price-earnings multiple around this level would be justified given all those considerations. This approach is more insightful than traditional benchmarks because it tailors the expected multiple to the company’s specific outlook and risk environment.

With Coeur Mining’s P/E ratio of 62.9x above its Fair Ratio of 52.7x, the stock appears to be trading above what would be considered a fair value on this measure. This suggests it is currently overvalued based on its earnings profile and risk.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

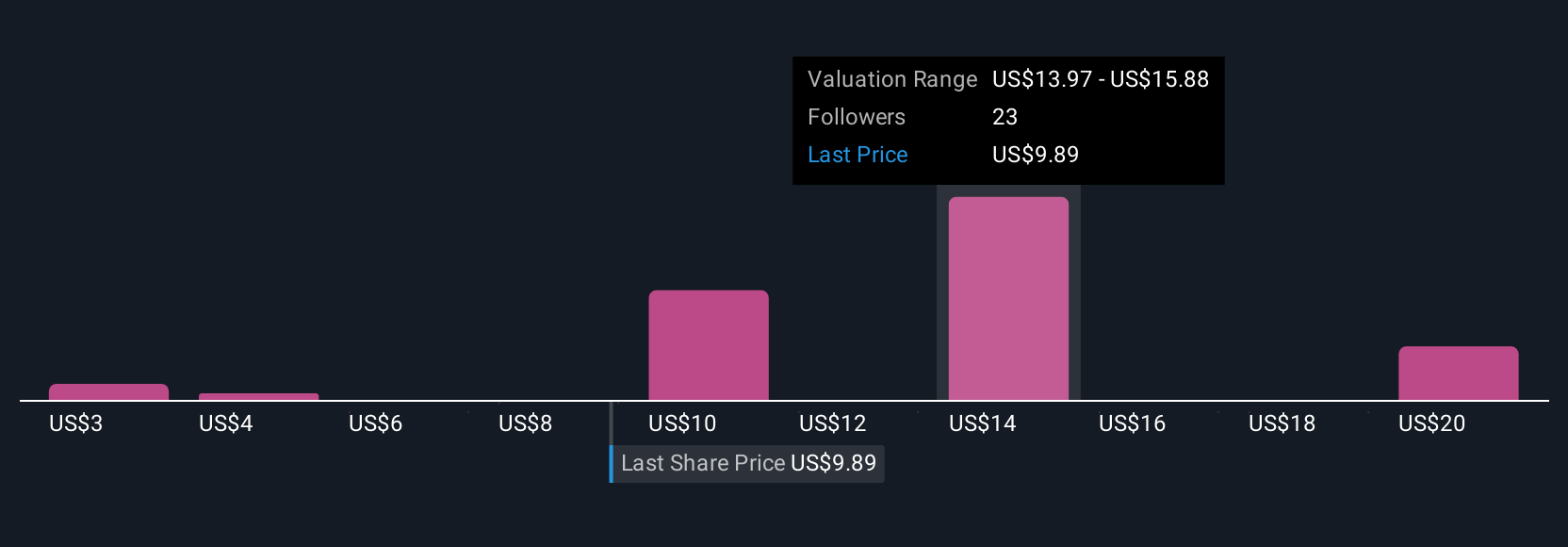

Upgrade Your Decision Making: Choose your Coeur Mining Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, an easy, accessible tool that puts you in control of investment analysis by linking a company’s story to its financial outlook and fair value. A Narrative is simply your personalized perspective or story about Coeur Mining, built on your own expectations for metrics like future revenue, earnings, and margins, and guided by what you think is possible for the business. Narratives not only bring the numbers to life but also help you forecast fair value based on your view of the company’s future and then directly compare it with the current share price, so you can quickly decide whether it’s time to buy, hold, or sell. Available to millions of investors in the Simply Wall St Community, Narratives update automatically as new news or earnings are released, ensuring your analysis stays relevant. For Coeur Mining, some investors might believe its expansion projects and industry demand could push fair value as high as $20.08 per share, while others, more cautious about regulatory or operational risks, see fair value closer to $12.00. The power of Narratives means you choose the version of the future you believe in and invest accordingly.

Do you think there’s more to the story for Coeur Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com