Examining Bristol-Myers Squibb Shares After Steep 22.8% Drop and Clinical Trial Updates

If you’re eyeing Bristol-Myers Squibb and wondering whether now is the time to act, you’re not alone. There’s been plenty of buzz around the stock lately and, candidly, it’s left investors searching for answers. The share price closed at $43.83 and, while that’s not far from where it started the month, the year-to-date performance tells a different story, with a steep loss of 22.8%. Over the past three years, the stock is down nearly 35%, so anyone holding on for the long term has certainly felt the sting.

But let’s zoom out for a moment. Despite the downward trend, there has been a shift in sentiment recently after several important clinical trial updates and moves in the pharmaceutical M&A space. These headlines have started to change how investors view Bristol-Myers Squibb’s growth prospects and risk profile, even if these stories haven’t yet translated into big short-term gains. Over the last week, the stock eked out a small 0.5% return, hinting at renewed interest. This could be a sign that the market is beginning to re-evaluate Bristol-Myers Squibb’s longer-term value.

So, where does Bristol-Myers Squibb stand in terms of value right now? According to a composite value score, the company checks the boxes in 4 out of 6 classic undervaluation markers. That’s not perfection, but it’s a strong showing and signals that there could be a disconnect between fundamentals and market price. Let’s dig into the different ways analysts look at valuation for a company like this. Keep in mind, there is an even more insightful approach to valuation that we’ll get to at the end.

Why Bristol-Myers Squibb is lagging behind its peers

Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them to today’s value. This approach is especially useful for companies with predictable cash generation, as it focuses on the business’s fundamentals rather than market sentiment.

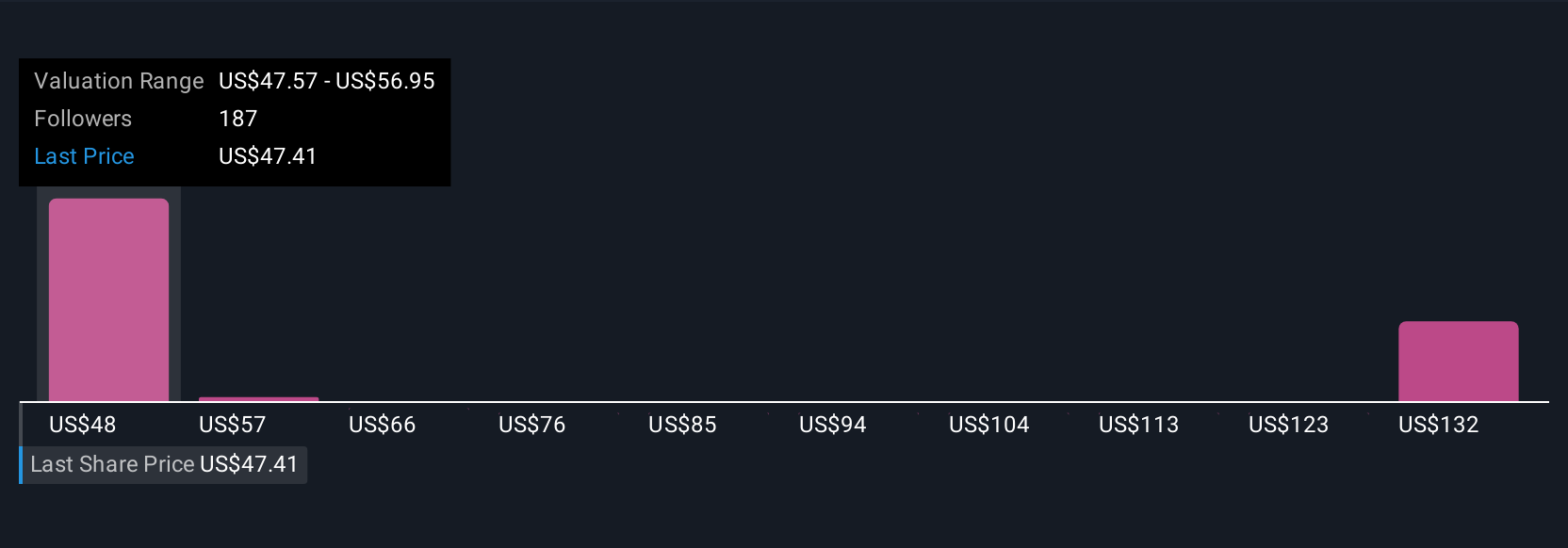

Bristol-Myers Squibb currently generates annual Free Cash Flow of $14.6 billion. Analysts provide specific projections for the next five years, with 2029’s FCF expected to be $11.8 billion. Further estimates for up to ten years are extrapolated by Simply Wall St, reflecting a modest decline in yearly free cash flow over the long term.

By using these projected figures and discounting them appropriately, the DCF model calculates an intrinsic fair value of $132.29 per share. Compared to the recent share price of $43.83, this signals a 66.9% discount. This indicates the market is heavily undervaluing Bristol-Myers Squibb based on these cash flow assumptions.

For investors focused on long-term fundamentals, this sizable disconnect suggests considerable upside potential if cash flows play out as projected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bristol-Myers Squibb is undervalued by 66.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bristol-Myers Squibb Price vs Earnings

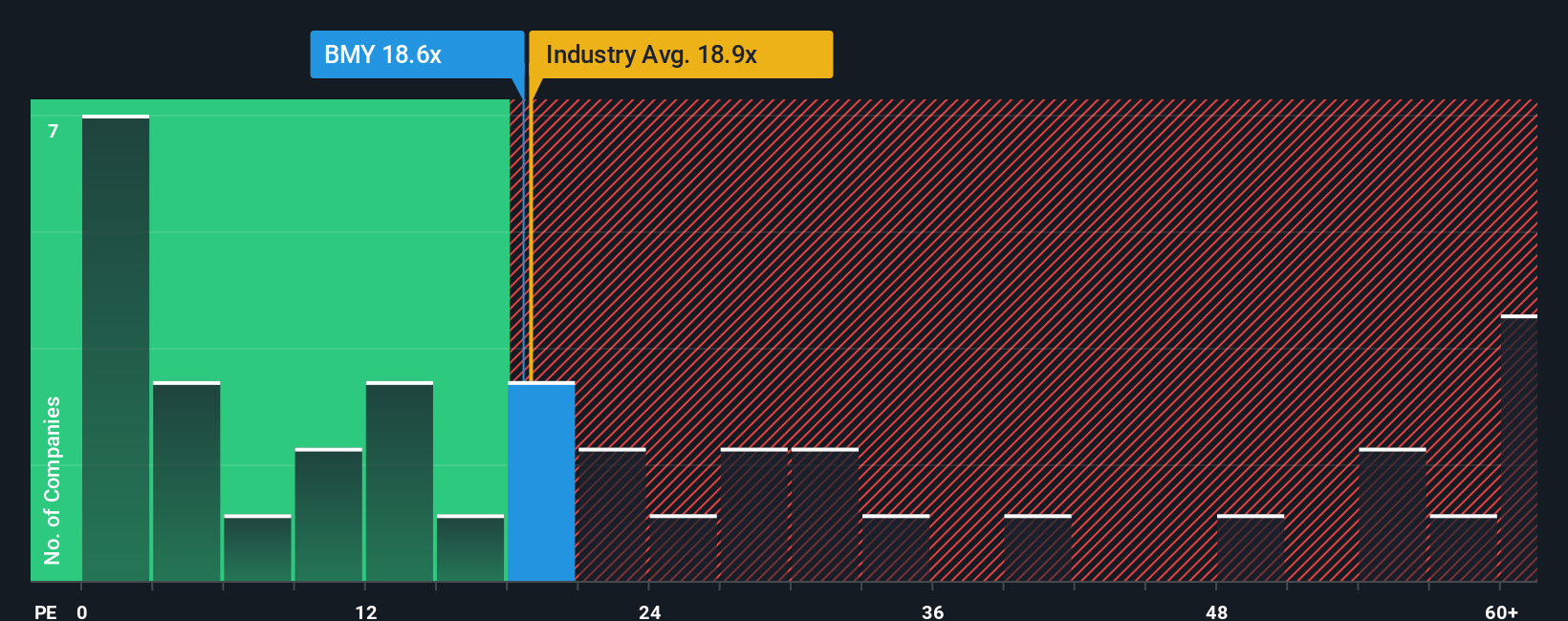

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Bristol-Myers Squibb. It tells investors how much they are paying for each dollar of the company’s earnings and is typically relied on when a company has a strong record of generating consistent profits.

Growth expectations and perceived risks both play a big part in what counts as a “normal” or “fair” PE ratio. Fast-growing companies or those with lower risk profiles tend to command higher PE multiples. In contrast, slower growth or higher uncertainty often leads to a lower PE being appropriate.

Bristol-Myers Squibb is currently trading at a PE multiple of 17.7x. For context, the Pharmaceuticals industry average is 17.7x, and its peers average around 16.7x. This means the stock’s price tag is very close to its industry and peer group.

Simply Wall St goes a step further with their proprietary “Fair Ratio,” which calculates the PE Bristol-Myers Squibb deserves by taking into account factors such as earnings growth, profit margins, risks, industry, and market cap. For Bristol-Myers Squibb, the Fair Ratio is 22.8x. This richer number suggests the stock may deserve to trade at a premium versus the broader industry and peer averages, thanks to its underlying qualities. Because the Fair Ratio considers so many additional company-specific factors, it provides a more tailored benchmark than a broad industry average ever could.

Comparing the actual PE of 17.7x to the Fair Ratio of 22.8x highlights that Bristol-Myers Squibb currently trades below its “deserved” multiple, pointing toward an undervalued stock based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple and powerful tool that lets you define your personalized story for a company, bringing together your assumptions on future revenues, earnings, margins, and what you believe the business deserves to be worth.

By creating a Narrative, you connect the company’s story with a set of forecasts and ultimately a fair value. For example, you might detail why you think Bristol-Myers Squibb will succeed or struggle. Narratives make investing less about following the crowd and more about aligning your decisions with your convictions. They are accessible to anyone using Simply Wall St’s Community page, already leveraged by millions of investors.

With Narratives, you can dynamically compare your fair value to the current market price, which may help you decide when you believe the stock is really undervalued or overvalued based on your own outlook. As new information such as quarterly earnings or regulatory news emerges, Narratives update in real-time, so your thesis stays current.

For Bristol-Myers Squibb, some investors are more bullish, valuing shares as high as $68 based on long-term pipeline optimism, while others set their Narrative at just $34, concerned about patent cliffs and increasing competition. Narratives bring these diverse outlooks to life, putting the power of fundamental analysis into your hands.

Do you think there’s more to the story for Bristol-Myers Squibb? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com