Exchange-traded funds (ETFs), which invest in artificial intelligence (AI) technology stocks in the ..

Exchange-traded funds (ETFs), which invest in artificial intelligence (AI) technology stocks in the U.S. stock market, are earning high returns, but products that choose stocks with AI algorithms are losing face below the market average.

According to the financial investment industry on the 26th, the return on AI algorithm ETFs listed on the U.S. stock market this year was half that of AI technology investment ETFs.

First of all, ETFs that invest in AI technology are making returns that far exceed the market average this year.

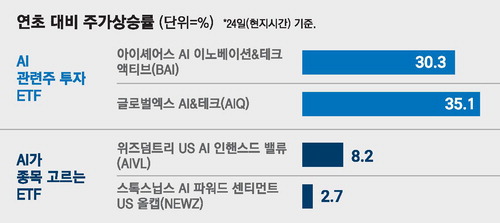

As of the 24th, iShares AI Innovation & Tech Active (BAI), which invests in AI technology, rose 30.3% from the beginning of the year. Similarly, ‘Global X AI&Tech (AIQ), which contains AI-related stocks, rose 35.1% during the period.

These ETFs are performing about twice as well as the growth rate (15.7%) of the S&P 500, the leading U.S. index.

On the other hand, most ETFs where AI makes investment decisions (AI Powered) or humans make investment decisions using AI as an auxiliary tool (AI Enhanced) were below the S&P 500 increase rate.

Amplify AI Powered Equities (AIEQ), which uses IBM’s reasoning AI ‘Watson’, a U.S. computing company, rose 15.2% from the beginning of the year. With the support of AI, ‘Wizdumtree US AI Enhanced Value (AIVL), which conducts value-share-oriented investment strategies, rose 8.2% during the same period. Stoxnips AI Powered Sentiment US All Cap (NEWZ), which focuses on news analysis, rose only 2.7%. Craft AI Enhanced US Large Cap Momentum (AMOM), developed by Korean company Kraft Technologies, rose 9.9% during the same period.

ETFs that have introduced AI algorithms implement various strategies such as value investment, momentum investment, and growth stock investment. However, most commodities are struggling to move beyond the market representative index. In particular, AIVL and NEWZ missed a lot of market gains as they did not include major technology stocks in the top portfolio stocks.

However, among products invested with AI technology, funds based on investor sentiment are making overwhelming returns this year. The “BUZZ,” which invests in “popular social networking services (SNS) stocks” selected by AI, rose 51% from the beginning of the year. As of the 24th, this product concentrates on technology stocks that are of great interest to investors, such as AST Space Mobile, Navius Group, and Intel.

ETFs that invest with AI technology generally set high fees. Except for AIVL, which has an annual total payoff of 0.38% (TER), AIEQ, NEWZ, and AMOM all have an annual total payoff of 0.75%. The total compensation of these products is similar to that of active ETFs directly managed by fund managers, but it is pointed out that the “cost-effectiveness” is low considering actual performance.

[Reporter Jeong Jaewon]