Is Hecla Mining Still Attractive After a 145% Surge and Promising Silver Discovery?

- If you are wondering whether Hecla Mining’s dramatic run makes it a bargain or a bubble, you are in the right place.

- The stock has surged 144.7% year-to-date and is up 102.0% over the past year, with plenty of price swings in between, making it definitely not your average miner.

- Investors have been buzzing as gold prices reach multi-year highs, and recent exploration results show promising new silver reserves. Headlines highlighting increasing demand for precious metals and ongoing sector consolidation have only fueled interest in the company.

- Despite all the excitement, Hecla Mining’s current valuation score stands at 0/6, reflecting that it is not undervalued on any of the standard metrics. Next, we will dig into the main approaches analysts use to judge value, and at the end, we will introduce a more insightful way to assess whether Hecla is truly worth your investment attention.

Hecla Mining scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hecla Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting those amounts back to their present value. This approach helps investors determine what a business is really worth today, based on its future cash-generating potential.

For Hecla Mining, current free cash flow is $52.95 million. Analysts supply projections for the next five years, with further estimates extrapolated. According to available data, Hecla’s free cash flow is forecast to reach $381.49 million by 2035. These numbers suggest significant expected growth from today’s levels. It is important to note that long-range forecasts are inherently uncertain and partially model-driven after the five-year mark.

The DCF model results in an estimated fair value of $10.27 per share. However, Hecla’s current share price sits roughly 25.3% above this intrinsic value, indicating the stock is overvalued based on this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hecla Mining may be overvalued by 25.3%. Discover 838 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hecla Mining Price vs Earnings

For established, profitable companies like Hecla Mining, the Price-to-Earnings (PE) ratio remains one of the most useful valuation tools. This metric tells investors how much they are paying for each dollar of the company’s earnings, making it a direct way to gauge value for a miner generating consistent profits.

What counts as a reasonable, or “fair,” PE ratio depends on multiple factors. Companies with faster earnings growth or lower risk typically warrant higher PE ratios, while slower growth or more risk merits a lower ratio. Context matters; benchmarks such as the industry average or peer group PE can provide perspective, but those numbers do not always capture the full picture for a specific business.

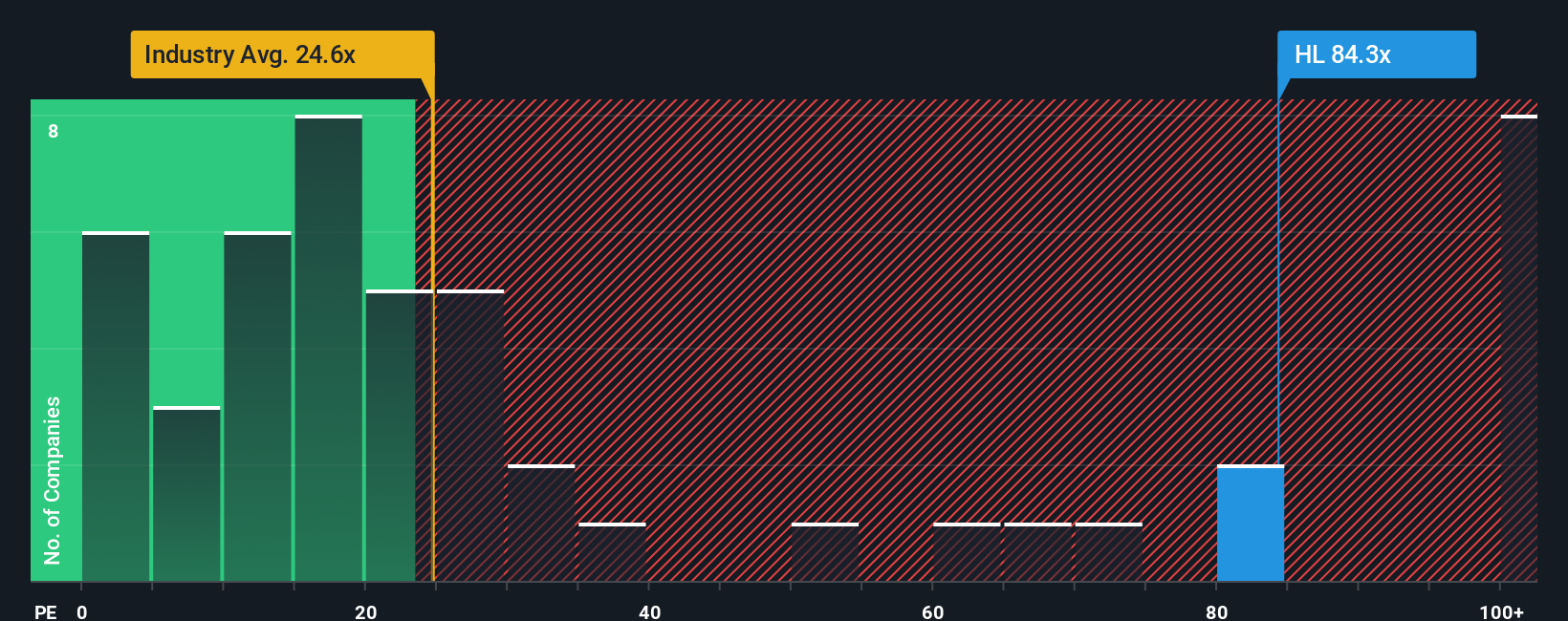

Currently, Hecla Mining trades at a hefty PE ratio of 86.5x. That is well above the Metals and Mining industry average of 24.1x, and higher than the peer average of 15.2x. On top of these metrics, Simply Wall St’s proprietary Fair Ratio, which accounts for the company’s unique profile including earnings growth potential, profit margin, industry, risk, and market cap, puts a fair PE at 34.9x for Hecla.

Relying solely on industry or peer averages can miss important nuances. Companies with higher growth or lower risk deserve consideration for a higher ratio, while the Fair Ratio pulls in all the relevant details to provide a more personalized benchmark.

With Hecla’s latest PE sitting substantially above its Fair Ratio, the stock looks overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hecla Mining Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative gives you the story behind a company’s numbers by combining your own perspective and assumptions about future revenue, earnings, and margins with financial forecasts to estimate a fair value.

Instead of relying on rigid formulas or static ratios, Narratives connect what’s happening in a business to real-life drivers such as new mines, commodity trends, or industry risks, then translate those insights directly into the numbers that matter.

Anyone can create or explore Narratives on Simply Wall St’s Community page, where millions of investors share and debate their outlooks. Narratives empower you to see clearly when a stock might be a buy or sell opportunity by comparing Fair Value, based on your view, to the current Price. They update dynamically as fresh news or quarterly results come in.

For Hecla Mining, for example, some investors use their Narrative to project strong gains driven by electrification trends and rising silver demand, with a fair value as high as $12.50. Others take a more cautious stance due to regulatory risks and dilution, arriving at a much lower estimate around $6.50.

Do you think there’s more to the story for Hecla Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com