Week in review: bitcoin shrugs off a rate cut as Solana ETFs debut

Fed cuts again; SOL ETFs launch; BIP-444 stirs debate; privacy coins rally.

The Fed cut rates for the second time in a row; SOL ETFs launched in the US; a new proposal to limit transaction sizes split the bitcoin community; Zcash led a privacy-coin rally; and more.

A stubborn market

The past seven days were unkind to cryptocurrencies, despite several ostensibly supportive catalysts.

On Monday, bitcoin opened higher at $116,000, but the cheer was short-lived. Until Wednesday the asset oscillated between $115,000 and $113,000 ahead of the Federal Reserve’s meeting.

On October 29 the regulator cut the key rate by 25 bps to 3.75–4%. According to the Fed, indicators point to moderate growth in economic activity while inflation remains elevated.

The central bank also announced it would wind down quantitative tightening from December 1. Chair Jerome Powell noted that the US economy is currently being materially affected by the government shutdown, which is also delaying the release of key indicators.

The move matched market expectations and, seemingly for that reason, failed to lift the leading cryptocurrency.

Almost immediately after the Fed meeting, digital gold slipped below $110,000. By Thursday the correction bottomed around $106,000.

Bitcoin then recovered to $110,000 after a “wonderful” meeting between the US and Chinese presidents—Donald Trump and Xi Jinping—where they agreed to ease tariffs.

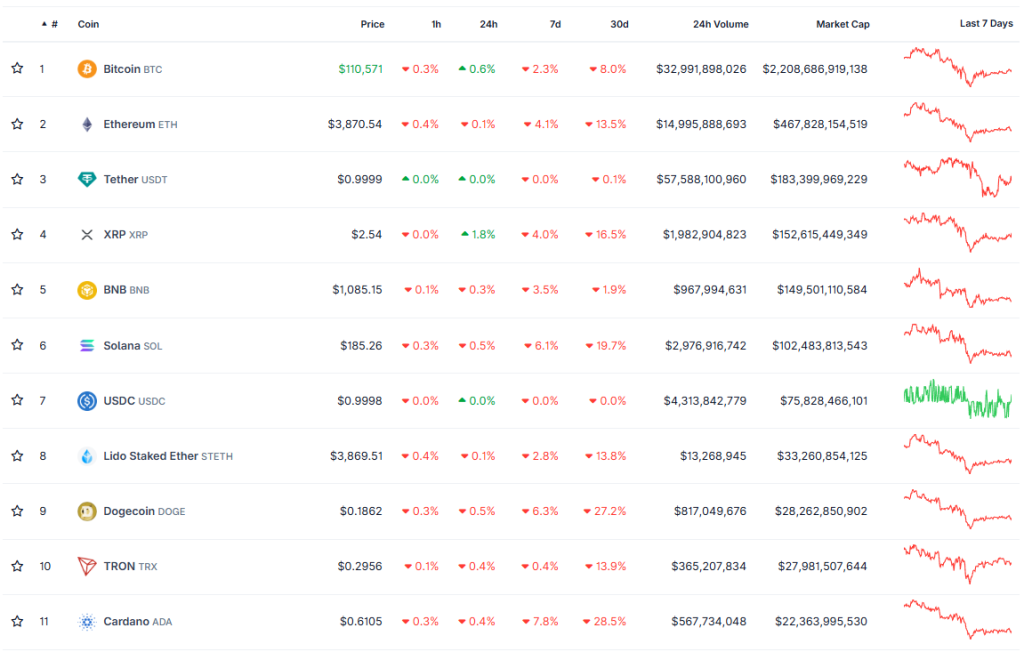

At the time of writing, digital gold trades around $110,700, down 5% on the week. Its market capitalisation is $2.2 trillion.

Ethereum also failed to hold above $4,000. Over seven days the coin fell from $4,200 to $3,800—down 9.5%.

Other top-10 assets also turned red. The worst performers were SOL (-6.1% over the week), DOGE (-6.3%) and ADA (-7.8%).

Total crypto market value fell to $3.8 trillion. Bitcoin dominance is 58%, Ethereum 12.3%.

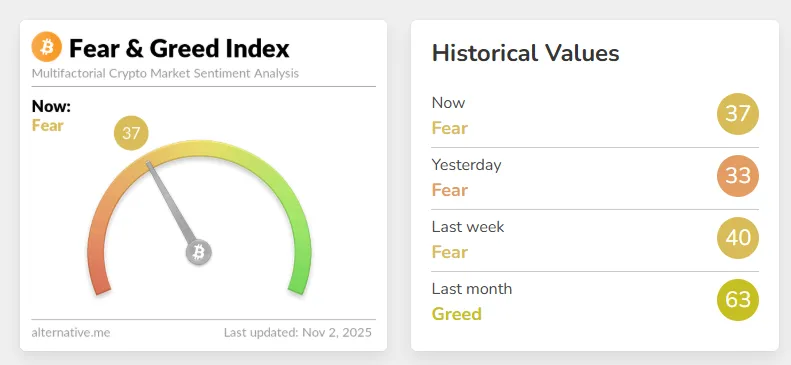

The Crypto Fear and Greed Index is at 37, indicating “fear”.

A strong start for SOL ETFs

On Tuesday, October 28, the first US spot exchange-traded fund based on Solana with staking—Bitwise’s BSOL—debuted on the NYSE. The company stakes 100% of assets in the protocol.

The next day Grayscale launched an ETF under the ticker GSOL, converted from a trust. Seventy-seven percent of coins are staked.

For the truncated trading week, net inflows totalled $199.2 million, and assets under management reached $500 million.

BSOL captured most of the flows and AUM—$197 million and $400 million, respectively. Average daily turnover was about $60 million.

Bloomberg ETF analyst Eric Balchunas said the Bitwise product delivered the strongest start among all funds launched this year.

Even so, SOL barely reacted. At the time of writing the asset trades around $185.

ETFs based on LTC and HBAR also launched during the week but attracted far less interest. Over the week the Hedera vehicle saw net inflows of $44 million, while the Litecoin product drew just $719,000.

Bitcoin ETFs, meanwhile, had a “red week” with outflows totalling $607 million. Ethereum funds took in net inflows of $114 million.

What to discuss with friends?

- Mt. Gox postponed repayments to creditors until October 2026.

- xAI launched a Wikipedia competitor.

- Hyperliquid and BNB Chain “eclipsed” Solana by fee revenue.

- Activity on Ethereum rose amid record-low gas costs.

Debating bytes

A new BIP-444 split the bitcoin community. The initiative would temporarily restrict the ability to add arbitrary data to the blockchain to reduce the risk of hosting illegal content.

“If the blockchain contains data that is illegal to store or distribute, node operators are forced to choose between breaking the law (or their moral principles) and disconnecting from the network. This unacceptable dilemma directly undermines incentives to validate, leads to inevitable centralisation and creates an existential threat to bitcoin’s security model,” the documentation states.

The change is aimed at limiting OP_RETURN, which some say clutters bitcoin’s blockchain. Previously, the Bitcoin Core v30 upgrade raised the data limit in outputs from 80 to 100,000 bytes.

In BIP-444 a developer using the pseudonym dathonohm proposed capping OP_RETURN outputs at 83 bytes and most other scriptPubKeys at 34.

This would block large scripts and data, including “inscriptions” via Ordinals, limit the size of embedded Merkle trees in Taproot outputs, and forbid OP_IF inside Tapscripts.

Implementing the proposal would require a soft fork, under which previously valid transactions would become invalid—but only for one year. During that time, the plan is to assess the situation and implement alternative methods for storing arbitrary data on-chain.

“This is not a perfect proposal, but good enough and simple enough to buy time for developing a long-term solution,” said lead Bitcoin Core developer Luke Dash Jr.

Critics of BIP-444 argue that limiting data sizes contradicts a fundamental principle of bitcoin and amounts to censorship, and that a soft fork could entail “legal or moral consequences”.

Privacy in demand

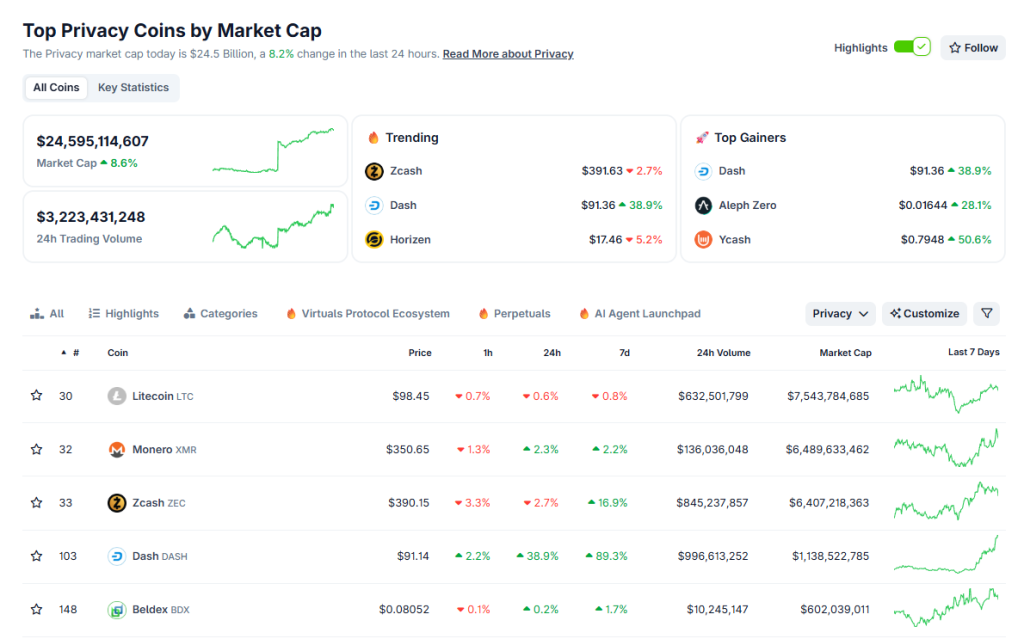

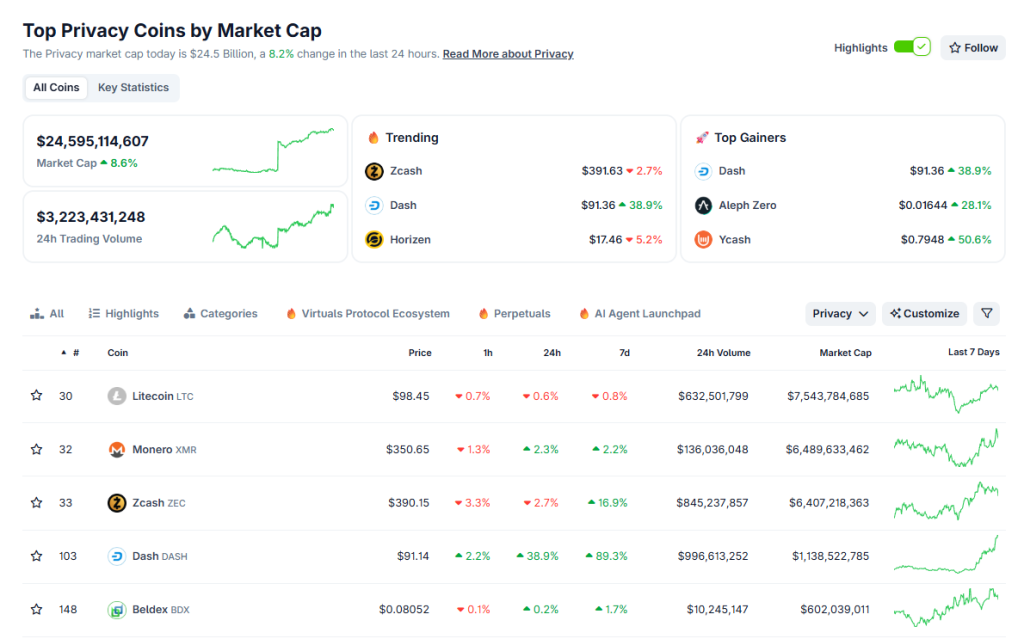

Over the past seven days, privacy tokens led the market by growth. Their combined capitalisation rose to $24 billion, according to CoinGecko.

The main driver was Zcash (ZEC). Over the past seven days the asset rose 16%; over the month, 163%.

At the time of writing the coin trades at $380.

Zcash matched Monero by market capitalisation and at times even surpassed it.

On October 28 the project marked its ninth anniversary. Since September, the volume of shielded transactions in the privacy coin has reached a record 4.9m ZEC.

Among other successful privacy coins was DASH. The asset rose 90% over the week to $91.

Also on ForkLog:

- Western Union will integrate stablecoins into money transfers.

- Circle launched the Arc blockchain testnet.

- Peter Brandt opened a short on bitcoin.

- S&P assigned Strategy an issuer rating in the “junk” category.

AI on Telegram

At the Blockchain Life in Dubai 2025 conference, Telegram founder Pavel Durov announced Cocoon—a decentralised network for privately executing AI requests on the TON blockchain.

The solution will allow app developers to pay for compute to process requests in Toncoin, while GPU owners will earn rewards for providing capacity.

“All data are encrypted, so participants cannot see which requests are being processed. You could call this ‘private AI on the TON blockchain’,” the project description states.

Telegram will be the network’s first client and will invest in its global roll-out. Cocoon is slated to launch in November.

Durov noted that the platform will allow more than one billion people to use AI features privately, transparently and efficiently.

What else to read?

On the past, present and possible future of digital-identity systems, read our new feature on ForkLog.

For the 17th anniversary of the bitcoin white paper, we explored how and why free money became digital gold.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!