US Natural Gas Futures Climb On Record LNG Export Demand

What’s going on here?

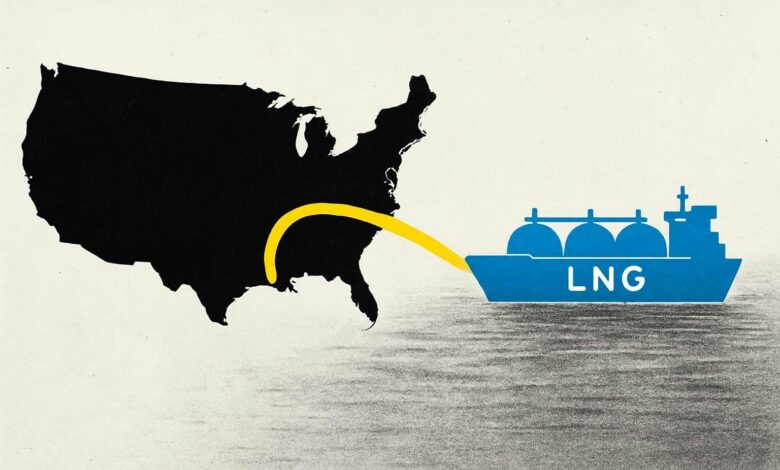

US natural gas prices have jumped to a seven-month high, fueled by record liquefied natural gas (LNG) exports and solid domestic output, even though mild weather is keeping heating demand in check.

What does this mean?

LNG exports from the US are smashing records, with eight major export terminals shipping out a record 17.2 billion cubic feet per day in November, based on data from LSEG. At the same time, domestic production has reached an all-time high, averaging 109 billion cubic feet per day. Even though storage levels are 4–4.6% above the five-year average, smaller-than-expected weekly additions are hinting at strong demand. The front-month natural gas contract has now stayed technically overbought for three straight days, showing speculators are piling in, despite lower heating needs thanks to warmer weather. Over the last three months, gas futures have surged 34% while oil prices have dropped 12%, pushing the oil-to-gas price ratio to its lowest mark since late 2022 and signaling a new dynamic in energy markets.

Why should I care?

For markets: Export demand rewrites the energy playbook.

Soaring LNG exports are reshaping price trends and investor moods across the natural gas sector. The spread between US benchmark Henry Hub – now at $3.57 per mmBtu – and global benchmarks like TTF and JKM keeps US exports attractive. Meanwhile, regional price differences, with places like Waha Hub lagging at $0.80 per mmBtu, point to shifting supply-demand balances across the US. As speculative trading heats up and natural gas’s dominance in American power generation holds firm, the market could see more volatility ahead.

The bigger picture: Global energy flows shape the next pricing era.

Global demand for US gas is redrawing energy supply chains, with stronger flows to Canada, Mexico, and across North America. Record production and shifting storage patterns reflect a market in flux, while data shows natural gas now fuels around 40% of US electricity. As oil prices slide and renewables continue to grow, brisk LNG demand could keep steering big-picture investment decisions into next year and beyond.