Assessing Asante Gold’s Value After 104.8% Rally and Exploration News in 2025

- Wondering whether Asante Gold is trading at a bargain, or if its impressive run has put the stock in the spotlight for a reason? You are not alone, as many investors are curious about its true worth.

- Asante Gold has delivered a staggering 104.8% return year-to-date and is up 55.5% over the past year. However, after a recent dip of 8.2% in the last 30 days, some are questioning if the rally can last.

- Recent headlines about new exploration results and management updates have kept the market’s attention fixed on Asante Gold. This suggests the fundamentals may be evolving alongside the share price. The company’s involvement in high-potential gold projects continues to generate buzz and encourage speculation about its future growth path.

- Right now, Asante Gold scores a 2 out of 6 under our valuation checks, which is just one lens through which to look at value. We’ll run through the usual valuation approaches in a moment. Stay tuned for a way to cut through the noise for real insights near the end of this article.

Asante Gold scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Asante Gold Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s terms. This approach is useful for companies like Asante Gold, where value depends on expected future cash generation.

For Asante Gold, the latest reported Free Cash Flow stands at $16.6 Million. Analysts provide growth estimates only for the next few years, but further projections up to 10 years are provided by Simply Wall St. For example, the company’s Free Cash Flow is forecasted to grow to $45.7 Million by 2035, with underlying estimates showing strong double-digit growth in the near term and a gradual slowdown thereafter.

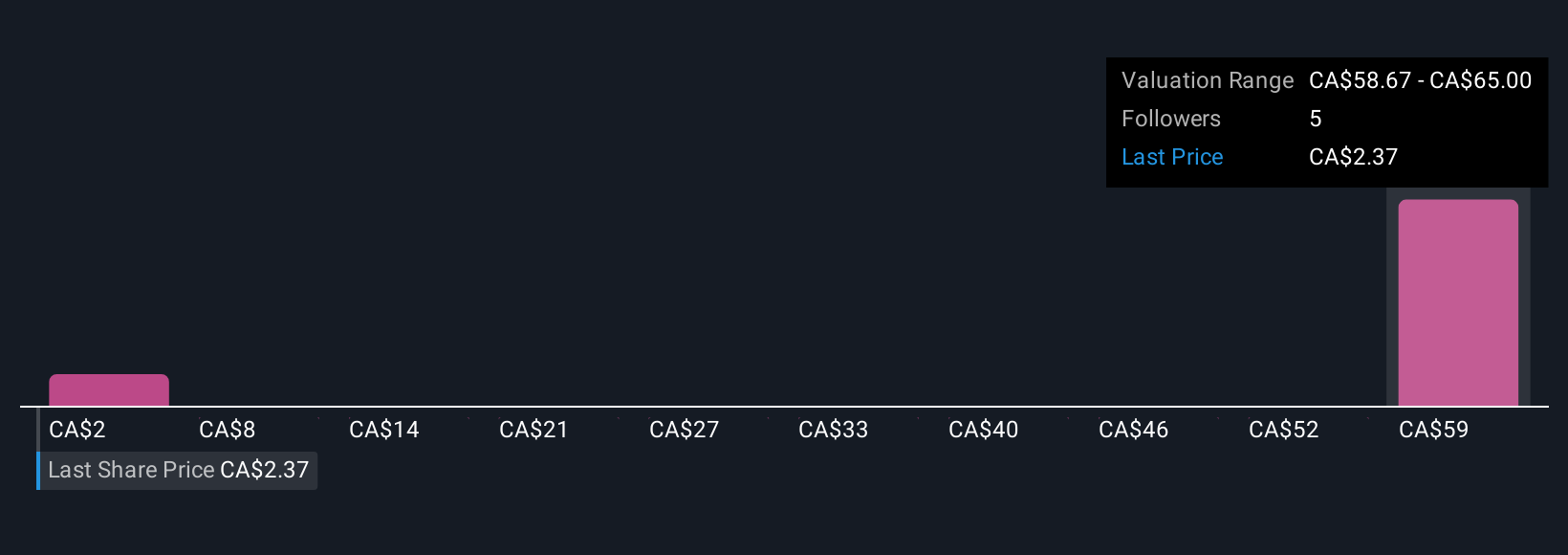

According to the DCF model, Asante Gold’s intrinsic value is estimated at $1.63 per share. With the current share price above this value by about 30.7%, the model suggests that Asante Gold is trading well above what its future cash flows may be worth today.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Asante Gold may be overvalued by 30.7%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Asante Gold Price vs Sales

The Price-to-Sales (P/S) ratio is often a preferred metric for valuing mining companies like Asante Gold, especially when profits may be volatile or negative but sales are more stable. This multiple helps investors compare a company’s value relative to its revenue and is particularly helpful when earnings are inconsistent.

A company with higher expected growth or lower risk typically justifies a higher P/S ratio. On the other hand, riskier or slower-growing firms often trade at a discount. For Asante Gold, the current P/S ratio is 2.28x. This is noticeably below the Metals and Mining industry average of 5.71x, as well as beneath the peer group average of 5.56x.

Simply Wall St’s proprietary “Fair Ratio” model goes a step further by estimating a P/S ratio that reflects the company’s sales growth, risks, profit margins, industry, and even market cap. Unlike a straight peer or industry comparison, the Fair Ratio provides a tailored benchmark that better aligns with the fundamentals and outlook unique to Asante Gold.

Comparing Asante Gold’s current P/S ratio of 2.28x to the Fair Ratio indicates the stock is undervalued by this measure. This suggests the share price does not yet reflect the company’s sales profile or growth prospects.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Asante Gold Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple but powerful way for investors to set out their unique perspective on a company by combining a story about where they see it headed with their own financial assumptions, such as fair value, future revenue, and margins. Narratives link a company’s real-world story directly to a personalized financial forecast and, ultimately, a fair value estimate.

Available on Simply Wall St’s Community page, Narratives make it easy for millions of investors to create and share their outlooks with others. By comparing your Fair Value estimate with the latest share price, Narratives help you decide whether to buy, hold, or sell based on your outlook. Whenever key news or earnings results are released, Narratives automatically update to keep your analysis relevant and current.

For example, with Asante Gold, one investor’s Narrative might predict robust growth and a higher fair value, while another’s takes a more cautious approach with a lower estimate, reflecting very different potential outcomes for the same stock.

Do you think there’s more to the story for Asante Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com