Gold Terra Targets 650K Oz Historical Gold Resource at Con Mine

Gold Terra (OTCQX:YGTFF) has unveiled plans for a strategic drilling program at the Con Mine in Yellowknife, targeting historical resources of 650,000 ounces of gold at 11-12 g/t. The program, set to commence before year-end 2025, focuses on the Campbell Shear structure, which historically produced 6.1 Moz between 1938 and 2003.

The company has identified a significant 1.4-kilometer-long Northern Extension target between 600-1,200 meters below surface. With current gold prices above US$3,700/oz compared to US$340/oz when the mine closed, Gold Terra aims to confirm historical resources and explore additional potential at lower cut-off grades. The company holds an option until November 2027 to acquire 100% of the CMO property from Newmont Corporation.

The current resource base includes 109,000 indicated ounces and 432,000 inferred ounces at the CMO Property, with plans to update the mineral resource estimate following the 2025-2026 drilling program.

Gold Terra (OTCQX:YGTFF) ha svelato piani per un programma di trivellazione strategica presso il Con Mine a Yellowknife, mirato a risorse storiche di 650.000 once di oro a 11-12 g/t. Il programma, che dovrebbe iniziare prima della fine del 2025, si concentra sulla struttura Campbell Shear, che storicamente ha prodotto 6,1 Moz tra il 1938 e il 2003.

L’azienda ha identificato un significativo obiettivo di estensione settentrionale di 1,4 chilometri di lunghezza tra 600-1.200 metri sotto la superficie. Con i prezzi attuali dell’oro superiori a US$3.700/oz rispetto agli US$340/oz quando la miniera chiuse, Gold Terra punta a confermare le risorse storiche ed esplorare ulteriori potenzialità a tagli di gradi inferiori. L’azienda detiene un’opzione fino a novembre 2027 per acquisire il 100% della proprietà CMO da Newmont Corporation.

La base attuale delle risorse comprende 109.000 once indicate e 432.000 once inferite per la proprietà CMO, con piani per aggiornare la stima delle risorse minerarie dopo il programma di trivellazione 2025-2026.

Gold Terra (OTCQX:YGTFF) ha revelado planes para un programa de perforación estratégico en la Mina Con en Yellowknife, apuntando a recursos históricos de 650.000 onzas de oro a 11-12 g/t. El programa, que comenzará antes de finales de 2025, se centra en la estructura Campbell Shear, que históricamente produjo 6.1 Moz entre 1938 y 2003.

La compañía ha identificado un significativo objetivo de Extensión Norte de 1,4 kilómetros de longitud entre 600-1,200 metros por debajo de la superficie. Con los precios actuales del oro por encima de US$3,700/oz en comparación con US$340/oz cuando la mina cerró, Gold Terra busca confirmar las reservas históricas y explorar potencial adicional a cortes de oro más bajos. La empresa tiene una opción hasta noviembre de 2027 para adquirir el 100% de la propiedad CMO de Newmont Corporation.

La base de recursos actual incluye 109.000 onzas indicadas y 432.000 onzas inferidas en la Propiedad CMO, con planes de actualizar la estimación de recursos minerales tras el programa de perforación 2025-2026.

Gold Terra (OTCQX:YGTFF)는 Yellowknife의 Con 광산에서 전략적 시추 프로그램 계획을 공개했으며, 11-12 g/t의 650,000온스의 금 자원을 목표로 합니다. 이 프로그램은 2025년 말 이전에 시작될 예정이며, 역사적으로 1938년~2003년 사이 6.1 Moz를 생산한 Campbell Shear 구조에 초점을 맞춥니다.

회사는 지상에서 600-1,200미터 아래에서 길이 1.4킬로미터의 북부 확장 타깃을 확인했습니다. 현재 금 가격이 미화 3,700달러/온스를 넘는 반면 광산이 문을 닫았을 때의 가격은 미화 340달러/온스였으며, Gold Terra는 과거 자원을 확인하고 더 낮은 커트오프 등재에서 추가 잠재력을 모색하는 것을 목표로 합니다. 회사는 Newmont Corporation으로부터 CMO 자산의 100%를 2027년 11월까지 인수할 수 있는 옵션을 보유하고 있습니다.

현재 자원 기반은 CMO 자산에서 지시된 109,000온스와 추정된 432,000온스를 포함하며, 2025-2026 시추 프로그램 이후 광물자원 추정치를 업데이트할 계획입니다.

Gold Terra (OTCQX:YGTFF) a dévoilé des plans pour un programme de forage stratégique à la Mine Con à Yellowknife, visant des ressources historiques de 650 000 onces d’or à 11-12 g/t. Le programme, qui doit débuter avant la fin de 2025, se concentre sur la structure Campbell Shear, qui a produit historiquement 6,1 Moz entre 1938 et 2003.

L’entreprise a identifié un objectif conséquent d’extension nord de 1,4 kilomètre entre 600 et 1 200 mètres sous la surface. Avec des prix de l’or actuels supérieurs à US$3 700/oz comparés à US$340/oz lors de la fermeture de la mine, Gold Terra vise à confirmer les ressources historiques et à explorer un potentiel additionnel à des teneurs de coupure plus bas. L’entreprise détient une option jusqu’en novembre 2027 pour acquérir 100% de la propriété CMO auprès de Newmont Corporation.

La base de ressources actuelle comprend 109 000 onces indicées et 432 000 onces inférées à la propriété CMO, avec des plans pour mettre à jour l’estimation des ressources minérales après le programme de forage 2025-2026.

Gold Terra (OTCQX:YGTFF) hat Pläne für ein strategisches Bohrprogramm bei der Con Mine in Yellowknife vorgestellt, das auf historische Ressourcen von 650.000 Unzen Gold bei 11-12 g/t abzielt. Das Programm soll vor Jahresende 2025 beginnen und konzentriert sich auf die Campbell Shear-Struktur, die historisch 6,1 Moz zwischen 1938 und 2003 produziert hat.

Das Unternehmen hat ein signifikantes Ziel der 1,4 Kilometer langen Northern Extension zwischen 600-1.200 Metern unter der Oberfläche identifiziert. Bei aktuellen Goldpreisen über US$3.700/oz im Vergleich zu US$340/oz, als die Mine geschlossen wurde, zielt Gold Terra darauf ab, historische Ressourcen zu bestätigen und zusätzliches Potenzial bei niedrigeren Cut-off-Quoten zu erkunden. Das Unternehmen hält eine Option bis November 2027, um 100% der CMO-Eigentum von Newmont Corporation zu erwerben.

Die aktuelle Ressourcenbasis umfasst 109.000 Unzen indicierte und 432.000 Unzen inferierte auf dem CMO-Anwesen, mit Plänen, die Mineralressourcenschätzung nach dem Bohrprogramm 2025-2026 zu aktualisieren.

Gold Terra (OTCQX:YGTFF) كشفت عن خطط لبرنامج حفر استراتيجي في منجم Con في Yellowknife، مستهدفة موارد تاريخية من 650,000 أونصة من الذهب عند 11-12 ج/ط. من المقرر أن يبدأ البرنامج قبل نهاية عام 2025، ويركز على بنية Campbell Shear، التي أُنتجت تاريخياً 6.1 Moz بين 1938 و2003.

حددت الشركة هدف امتداد شمالي بطول 1.4 كيلومتر بين عمق 600-1,200 متر تحت السطح. مع أسعار الذهب الحالية التي تتجاوز US$3,700/أونصة مقارنةً بـ US$340/أونصة عندما أغلقت المنجم، تهدف Gold Terra إلى تأكيد الموارد التاريخية واستكشاف إمكانات إضافية عند درجات قطع أدنى. الشركة لديها خيار حتى نوفمبر 2027 لاستحواذ على 100% من ممتلك CMO من نيومونت كوربوريشن.

تشمل القاعدة الحالية للموارد 109,000 أونصة محددة و 432,000 أونصة مستنتجة في ممتلك CMO، مع خطط لتحديث تقدير الموارد المعدنية عقب برنامج الحفر 2025-2026.

Gold Terra (OTCQX:YGTFF) 已公布在 Yellowknife 的 Con 采矿区进行战略钻探计划,目标是历史资源中的 65万盎司金,品位为11-12 g/t。该计划计划在 2025 年底前启动,聚焦于 Campbell Shear 结构,该结构在历史上在 1938 至 2003 年间产出 610 万盎司。

公司已确定一个显著的 1.4 公里长的北部延伸目标,位于地表下方 600-1,200 米之间。考虑到当前金价高于 US$3,700/oz,而矿山关闭时仅为 US$340/oz,Gold Terra 旨在确认历史资源并在较低割位下探寻额外潜力。公司拥有一项至 2027 年11月的选择权,可从 Newmont Corporation 收购 CMO 资产的 100%

目前的资源基础包括在 CMO 资产处的 109,000 盎司为已指示和 432,000 盎司为推断,并计划在 2025-2026 年钻探计划后更新矿产资源估算。

Positive

- Strategic drilling targets identified in a historically productive mine that yielded 6.1 Moz of gold

- Higher gold prices (US$3,700/oz vs. US$340/oz at mine closure) enable exploration of lower grade deposits

- Significant 1.4km Northern Extension target identified with existing underground infrastructure

- Option agreement with Newmont until 2027 provides time for resource development

- Current resource base of 109,000 indicated and 432,000 inferred ounces with potential for expansion

Negative

- Additional drilling required to verify and upgrade historical resources

- Resource confirmation and economic studies still pending

- Acquisition of CMO property subject to conditions with Newmont

VANCOUVER, BC / ACCESS Newswire / September 26, 2025 / Gold Terra Resource Corp. (TSXV:YGT)(Frankfurt:TX0)(OTCQX:YGTFF) (“Gold Terra” or the “Company“) has completed its review of the Con Mine 2002 historical resources of 650,000 ounces of gold at between 11-12 g/t dated January 1st 2003 (see Note 1 further in this news release). Based on the review, selected priority targets have been established for the upcoming drilling program scheduled to start before year end 2025 that will focus on the past producing Campbell Shear (“CS”) structure. The goal of this drilling program is to confirm portions of the historical resources and investigate additional potential resources at lower cut-off grades, reflecting the current higher gold prices of today. This confirmation drilling could contribute to further increases to the current resource base of the Company prior to proceeding with economic studies.

Gold Terra has identified numerous historical targets within the Con Mine underground infrastructure between 500 metres to 1000 metres below surface. The Con Mine produced a total of 6.1 Moz between 1938 and 2003 and closed at a time when gold price averaged US

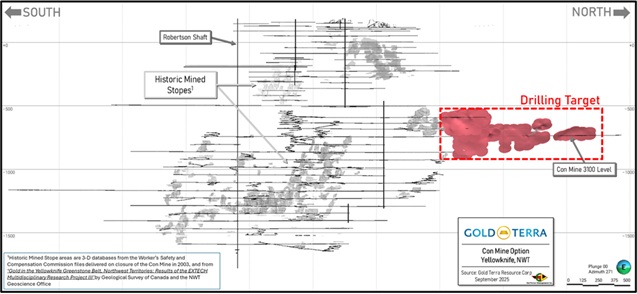

The largest of these targets (see Figure 1 and 1A) is an interpreted 1.4 kilometre long Northern Extension of the Campbell Shear structure between section 6600N and 8000N, and between 600 metres to 1,200 metres below surface, which was previously drilled in the 1990’s from underground stations between level 1900 and 2900 (580 metres and 885 metres).

The proposed plan is to:

-

Drill at 100 metres spacing to confirm the underground historical drill results which extend for more than 1 kilometer north of the Con Mine.

-

Test three (3) other areas between 800 metres vertical to 1400 metres within the Con Mine main ore body that weren’t mined historically.

-

Test and In-fill drill in the Con Mine south area where the Company has already outlined a NI43-101 resource on the Yellorex and Yellorex North deposits (See Note 2 further in the press release- Mineral Resource Estimate (MRE) dated September 2022). This drilling is intended to bring this area up to a Drill Indicated confidence level and increase the size of the Yellorex and Yellorex North zones which remained open along strike and plunge following the October 2022 NI43-101 mineral resource estimate.

Chairman and CEO, Gerald Panneton, commented, “In this current gold price environment, we have reviewed over the summer many additional targets at the Con Mine well within reach of existing underground infrastructure. With gold price now well above US

Following the completion of the 2025-2026 drilling program, the Company is planning to update its 2022 Mineral Resources Estimate (MRE) (See Note 2 further in this press release) which will include the new drilling results, a higher gold price and potentially a lower cut-off grade. It is anticipated that the updated MRE will be followed by a Preliminary Economic Assessment (PEA).

Under the CMO agreement, the Company has the right to acquire

Figure 1 -Composite Long Section showing the location of the planned 2025-2026 drilling program:

Figure 1A – North Extension Drilling Target Projected on the Historic Mine Stopes of the Con Mine:

Notes:

Note 1. Historical Estimate:

The Con Mine closed in 2003 at a time when the gold price was around US

Refer to the October 21, 2022 technical report, titled “Initial Mineral Resource Estimate for the CMO Property, Yellowknife City Gold Project, Yellowknife, Northwest Territories, Canada” with an effective date of September 2, 2022, by Qualified Person, Allan Armitage, Ph. D., P. Geo., SGS Geological Services, which can be found on the Company’s website at https://www.goldterracorp.com and on SEDAR+ at www.sedarplus.ca.

Source: MNML

|

Mineral Reserves |

Tonnes |

Grade (g/t) |

Contained Ounces |

|

|

Proven |

171,000 |

11.31 |

62,000 |

|

|

Probable |

340,000 |

11.66 |

126,000 |

|

|

Mineral Resources |

||||

|

Measured |

408,000 |

12.03 |

158,000 |

|

|

Indicated |

875,000 |

10.97 |

304,000 |

The historical estimates are historical in nature and should not be relied upon, however, they do give indications of mineralization on the property. The Qualified Person has not done sufficient work to classify them as current Mineral Resources or Mineral Reserves and Gold Terra is not treating the historical estimates as current Mineral Resources or Mineral Reserves. Parameters for the resource/reserve categories listed above are not known.

Note 2, October 2022 Mineral Resource Estimate:

Indicated and Inferred resources (MRE October 2022 – see Gold Terra’s Oct. 21, 2022 Technical Report) near surface and south of the Con Mine are shown in the table below:

|

Area |

Category |

Cut-off Grade (g/t Au) |

Tonnes |

Grade (g/t Au) |

Contained Gold Ounces |

|

CMO Property |

|||||

|

Yellorex Main |

Indicated /UG |

3.5 |

821,000 |

7.55 |

109,000 |

|

Inferred/UG |

3.5 |

993,000 |

6.89 |

220,000 |

|

|

Yellorex North |

Inferred/UG |

3.5 |

463,000 |

7.42 |

111,000 |

|

Kam Point |

Inferred/UG |

3.5 |

536,000 |

5.83 |

101,000 |

|

Total: |

Indicated/UG |

3.5 |

821,000 |

7.55 |

109,000 |

|

Inferred/UG |

3.5 |

1,992,000 |

6.74 |

432,000 |

-

The classification of the current Mineral Resource Estimate into Indicated and Inferred is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

-

Additional drilling will be required to upgrade/verify the resource estimates.

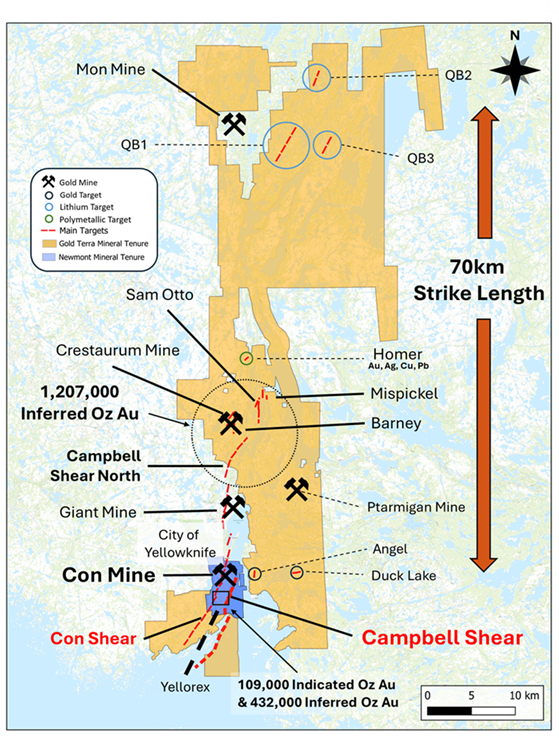

Yellowknife Project 2021 MRE:

The Yellowknife Project has an extensive land position with over 836 square kilometres covering 70 kilometers of the CS and the previous exploration results indicate the potential to host multiple deposits. To date, the Yellowknife Project’s contiguous Northbelt Property has a March 2021 mineral resource estimate of 1,207,000 inferred ounces 15 km north of the Con Mine and the city of Yellowknife in 4 satellite deposits, with the Crestaurum open pit @ 6 g/t Au (see Gold Terra’s Oct. 21, 2022 Technical Report).

For current resource estimates please refer to the October 21, 2022 technical report, titled “Initial Mineral Resource Estimate for the CMO Property, Yellowknife City Gold Project, Yellowknife, Northwest Territories, Canada” with an effective date of September 2, 2022, by Qualified Person, Allan Armitage, Ph. D., P. Geo., SGS Geological Services, which can be found on the Company’s website at https://www.goldterracorp.com and on SEDAR at www.sedarplus.com.

Gold Terra’s strategic land holdings covering an extensive mineralized system in the Yellowknife Gold Belt are shown in the figure below:

The technical information contained in this news release has been reviewed and approved by Joseph Campbell, a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects and Senior Technical Advisor for the Company.

About Gold Terra

The Yellowknife Project (YP) encompasses 836 sq. km of contiguous land immediately north, south and east of the City of Yellowknife in the Northwest Territories. Through a series of acquisitions, Gold Terra controls one of the six major high-grade gold camps in Canada. Being within 10 kilmetres of the City of Yellowknife, the YP is close to vital infrastructure, including all-season roads, air transportation, service providers, hydro-electric power, and skilled tradespeople. Gold Terra is currently focusing its drilling on the prolific Campbell Shear, where approximately 14 Moz of gold has been produced, and most recently on the Con Mine Option (CMO) Property, immediately south of the past producing Con Mine which produced 6.1 Moz between the Con, Rycon, and Campbell shear structures (1938-2003) (refer to Gold Terra Oct 21, 2022, Technical Report).

The YP and CMO properties lie on the prolific Yellowknife greenstone belt, covering nearly 70 kilometres of strike length along the main mineralized shear system that hosts the former-producing high-grade Con and Giant gold mines. The Company’s exploration programs have successfully identified significant zones of gold mineralization and multiple targets that remain to be tested which reinforces the Company’s objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

Visit our website at www.goldterracorp.com.

For more information, please contact:

Gerald Panneton, Chairman & CEO

gpanneton@goldterracorp.com

Mara Strazdins, Investor Relations

Phone: 1-778-897-1590 | 416-710-0646

strazdins@goldterracorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information Concerning Estimates of Mineral Resources

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Therefore, investors are cautioned not to assume that all or any part of an Inferred Mineral Resource could ever be mined economically. It cannot be assumed that all or any part of “Measured Mineral Resources,” “Indicated Mineral Resources,” or “Inferred Mineral Resources” will ever be upgraded to a higher category. The Mineral Resource estimates contained herein may be subject to legal, political, environmental or other risks that could materially affect the potential development of such mineral resources. Refer to the Technical Report, once filed, for more information with respect to the key assumptions, parameters, methods and risks of determination associated with the foregoing.

Cautionary Note Regarding Historical Estimates and Newmont Corporation’s Involvement

The historical estimate referenced in this press release, which was carried out during the operation and closure of the Con Mine by Newmont’s predecessor company (2003), are provided for historic context only. These estimates do not reflect Newmont’s current resource base. Gold Terra is solely responsible for the exploration and verification of these resources, and any updated estimates will need to comply with current industry standards. Newmont Corporation is not responsible for Gold Terra’s exploration activities, nor for any resource updates or future developments related to the CMO Property.

Cautionary Note to United States Investors

The Company prepares its disclosure in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Terms relating to Mineral Resources in this news release are defined in accordance with NI 43-101 under the guidelines set out in CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council on May 19, 2014, as amended (“CIM Standards”). The U.S. Securities and Exchange Commission (the “SEC”) has adopted amendments effective February 25, 2019 (the “SEC Modernization Rules”) to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the U.S. Securities Exchange Act of 1934. As a result of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are defined in substantially similar terms to the corresponding CIM Standards. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to the corresponding CIM Standards.

U.S. investors are cautioned that while the foregoing terms are “substantially similar” to corresponding definitions under the CIM Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any Mineral Resources that the Company may report as “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under NI 43-101 would be the same had the Company prepared the Mineral Resource estimates under the standards adopted under the SEC Modernization Rules. In accordance with Canadian securities laws, estimates of “Inferred Mineral Resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Cautionary Note Regarding Forward-Looking Information

Certain statements made and information contained in this news release constitute “forward-looking information” within the meaning of applicable securities legislation (“forward-looking information“). Generally, this forward-looking information can, but not always, be identified by use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events, conditions or results “will”, “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative connotations thereof.

All statements other than statements of historical fact may be forward-looking information. Forward-looking information is necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information. In particular, this news release contains forward-looking information regarding the current drilling on the Campbell Shear, potentially adding ounces to the Company’s current YCG mineral resource, and the Company’s objective of re-establishing Yellowknife as one of the premier gold mining districts in Canada.

There can be no assurance that such statements will prove to be accurate, as the Company’s actual results and future events could differ materially from those anticipated in this forward-looking information as a result of the factors discussed in the “Risk Factors” section in the Company’s most recent MD&A and annual information form available under the Company’s profile at www.sedar.com.

Although the Company has attempted to identify important factors that would cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. The forward-looking information contained in this news release is based on information available to the Company as of the date of this news release. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. All of the forward-looking information contained in this news release is qualified by these cautionary statements. Readers are cautioned not to place undue reliance on forward-looking information due to the inherent uncertainty thereof. Except as required under applicable securities legislation and regulations applicable to the Company, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

SOURCE: Gold Terra Resource Corp

View the original press release on ACCESS Newswire

FAQ

What are Gold Terra’s (YGTFF) new drilling targets at the Con Mine?

Gold Terra is targeting a 1.4-kilometer-long Northern Extension of the Campbell Shear structure between 600-1,200 meters below surface, along with three other areas between 800-1400 meters vertical within the Con Mine main ore body.

How much gold did the Con Mine historically produce?

The Con Mine historically produced 6.1 million ounces of gold between 1938 and 2003, closing when gold prices averaged US$340 per ounce.

What is Gold Terra’s current resource estimate at the CMO Property?

The CMO Property currently has 109,000 indicated ounces at 7.55 g/t Au and 432,000 inferred ounces at 6.74 g/t Au.

When will Gold Terra begin its new drilling program at Con Mine?

Gold Terra plans to start the drilling program before the end of 2025, focusing on confirming historical resources and exploring additional potential at lower cut-off grades.

What is the historical resource being targeted at Con Mine?

The company is targeting historical resources of 650,000 ounces of gold at 11-12 g/t that were reported when the mine closed in 2003.

Credit: Source link