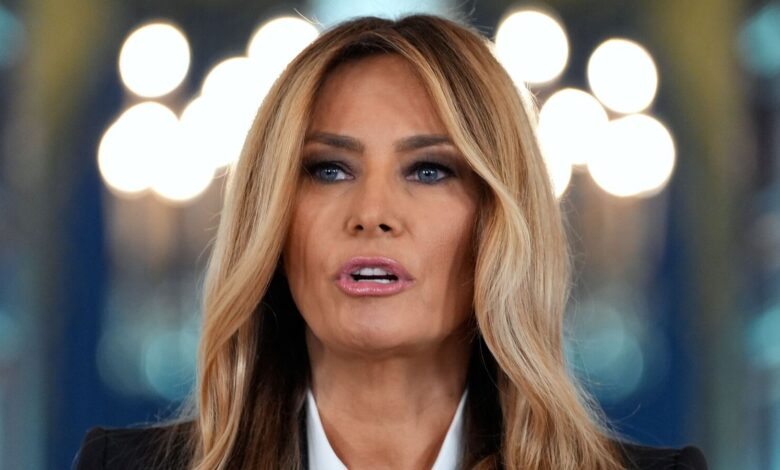

Melania Trump’s name was exploited in pump-and-dump crypto scam that wiped out $MELANIA investors, lawsuit claims

Two cryptocurrency entrepreneurs behind tokens promoted by First Lady Melania Trump have been accused of orchestrating a wide-ranging fraud scheme using “celebrity association and borrowed fame” to lure investors, according to an amended federal lawsuit.

Racketeering allegations

The class-action suit targets Benjamin Chow, co-founder of crypto exchange Meteora, and Hayden Davis of venture firm Kelsier Labs. It was first filed in April alleging a multimillion-dollar scam tied to a single memecoin, $M3M3, Wired reported. The complaint has since expanded to include claims of racketeering and market manipulation involving multiple tokens.

The filing accuses the pair of engineering a system to inflate prices artificially and then offload their holdings for profit at the expense of retail buyers.

Celebrity-driven “playbook”

The newly proposed version of the complaint submitted Tuesday alleges the duo pumped and dumped at least 15 cryptocurrencies, including $MELANIA, which leveraged Melania Trump’s image and online following.

Chow and Davis had created a “repeatable six-step ‘playbook’ for pump-and-dump fraud,” the filing states. Meteora allegedly handled the technical infrastructure, while Kelsier funded launches and managed promotions.

In the case of $MELANIA, the lawsuit claims Kelsier paid crypto influencers to hype the token online.

Melania Trump post boosted hype

Melania Trump promoted the coin on X on January 19, the day before Donald Trump’s second inauguration, writing:“The Official Melania Meme is live! You can buy $MELANIA now.”

She is not named as a defendant. Lawyers say she was used as “window dressing for a crime engineered by Meteora and Kelsier.”

Investors, the complaint argues, “reasonably interpreted the use of Melania Trump’s name and likeness as evidence of legitimacy and due diligence – trusting that no one of her stature would knowingly associate with a fraudulent venture.”

Market takeover behind the scenes

According to the suit, wallets linked to Chow and Davis secretly amassed almost one-third of the token’s supply before public trading began, meaning “insiders had already cornered the market before a single public buyer could act.”

When the coin surged twelve-fold to a peak valuation of $1.6 billion, insiders allegedly began dumping their holdings, making millions and triggering a 95 percent crash that left ordinary investors with steep losses.

Political credibility misused

The complaint says these tactics were also used in coins promoted by Argentina’s President Javier Milei, including $LIBRA, which also tanked after launch.

“The misuse of Melania Trump’s name magnified the harm,” the filing says. “It corrupted public trust and injected an element of political and cultural credibility into what was, in reality, a standard pump-and-dump.”