Stock Futures Soar After Encouraging September CPI

CPI is helping Wall Street forget about trade tensions with Canada

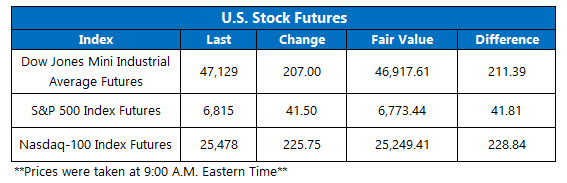

Stock futures look poised to finish the week strong, with all eyes on the consumer price index (CPI), the first piece of major economic data released in 24 days. Futures on the Dow Jones Industrial Average (DJIA), S&P 500 Index (SPX), and Nasdaq-100 Index (NDX) are extending yesterday’s gains after September’s CPI came in at 3%, lower than the 3.1% estimate, but higher than August’s reading. These numbers are expected to open the door for a potential two further interest rate cuts this calendar year.

The report is also overshadowing trade tensions between the U.S. and Canada. President Donald Trump claimed he was terminating all trade negotiations with Canada, after the Ontario provincial government released a TV commercial featuring former President Ronald Reagan speaking negatively about tariffs.

5 Things You Need to Know Today

- The Cboe Options Exchange saw more than 2.6 million call contracts and roughly 1.5 million put contracts exchanged on Thursday. The single-session equity put/call ratio rose to 60, while the 21-day moving average remained at 0.58.

- Newmont Corporation (NYSE:NEM) stock is 6.1% lower before the bell, despite the gold miner reporting third-quarter earnings and revenue that topped estimates. The company’s warning of a weak Q4 output and cash flow is weighing on shares. Newmont stock is 139% higher in 2025 heading into today, and could be testing its 50-day trendline.

- Coinbase Global Inc (NASDAQ:COIN) stock is 4.1% higher ahead of the open, after J.P. Morgan Securities upgraded the cryptocurrency exchange to “overweight” from “neutral.” The analyst in coverage also hiked its price target to $404 from $342, and is bullish on new finance platform Base. Coinbase stock is up 62% year-over-year.

- The shares of Target Corp (NYSE:TGT) are in focus this morning, after the retailer announced it was trimming 8% of its corporate workforce. This is the company’s first round of major layoffs. TGT is nursing a 30.2% deficit for 2025, and is staring up at a confluence of overhead moving averages.

- All eyes are on the Fed next week.

Record Highs For Kospi, Japan CPI Lifts Nikkei

The South Korean Kospi marked another record high today, adding 2.5% as investors eyed President Donald Trump’s meeting with China’s President Xi Jinping next week. Core inflation in Japan rose to 2.9% in September, meeting expectations and pushing the region’s Nikkei up 1.4%. China’s Shanghai Composite also welcomed a win, settling 0.7% higher alongside Hong Kong’s Hang Seng.

Markets are mostly lower in Europe, brushing off yesterday’s major earnings sweep. Tariffs out of the European Union (EU) against Russia complemented U.S. sanctions, with investors also monitoring Canada’s response to trade tensions with the U.S. At last check, London’s FTSE 100 is up 0.06%, Germany’s DAX is off 0.02%, and France’s CAC 40 is 0.5% lower.