Bond Market

-

Google owner Alphabet to tap U.S. dollar, euro bond markets

A representative for Alphabet did not immediately return a request for comment [File] | Photo Credit: REUTERS Google owner Alphabet…

Read More » -

Trading Day: Economic reality damps AI, deals optimism | The Mighty 790 KFGO

By Jamie McGeever ORLANDO, Florida (Reuters) -Wall Street was mixed on Monday, with bumper corporate dealmaking activity and another mega…

Read More » -

Google owner Alphabet to tap US dollar, euro bond markets

WASHINGTON :Google owner Alphabet is tapping the U.S. dollar and euro debt markets in a multi-tranche senior unsecured notes offering.…

Read More » -

Troubled nations return to debt markets amid yield hunt

Sovereign bonds from some of the riskiest borrowers are back. by Zijia Song, Vinícius Andrade and Carolina Wilson Some of the…

Read More » -

The market that’s priced too perfect

Priced too perfect? It’s one of the strangest earnings seasons in years — maybe ever. AI has already conquered the…

Read More » -

Drought is quietly pushing American cities toward a fiscal cliff

This story was originally published by Grist. Sign up for Grist’s weekly newsletter here. By Tik Root, Grist The city…

Read More » -

It is estimated that U.S. artificial intelligence (AI) companies have issued more than $200 billion ..

사진 확대 It is estimated that U.S. artificial intelligence (AI) companies have issued more than $200 billion (about 286.14 trillion…

Read More » -

Fed QT Ends. What Does That Mean For Markets?

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you’d…

Read More » -

The narrative of Fed rate cuts shifts! Market scales back December rate cut bets; the ‘global asset pricing anchor’ reestablishes above 4%.

The 10-year U.S. Treasury yield closed above 4% this week, primarily as traders significantly scaled back their bets on interest…

Read More » -

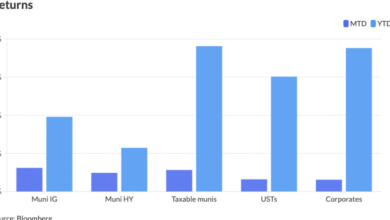

Munis quiet to end October, issuance set to rebound

<img src=”https://public.flourish.studio/visualisation/25963874/thumbnail” width=”100%” alt=”chart visualization” /> Munis were steady Friday ahead of a larger new-issue calendar, as U.S. Treasuries were…

Read More »