You’ve Been On TikTok, Haven’t You?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

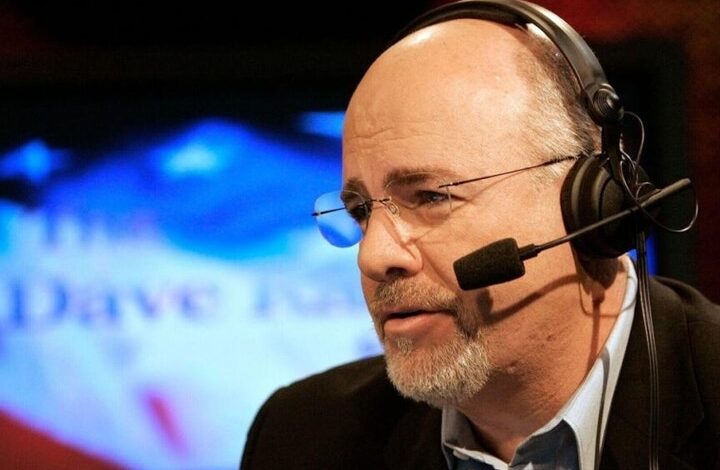

Cecelia, a real estate agent of five years, called into “The Ramsey Show” with a question that immediately set off alarms for personal finance expert Dave Ramsey.

She asked whether it was safe to leverage home equity lines of credit to buy investment properties, even though she tries to avoid debt. Ramsey cut in: “You realize your sentences just ran against each other, right? I mean, I don’t want any debt. Should I go into debt? That was what you just told me. I’m confused.”

Don’t Miss:

Before Cecelia could explain further, Ramsey jumped in: “I think you’ve been spending a lot of time on TikTok, haven’t you?” Cecelia clarified that she wasn’t following TikTok influencers but instead heard this strategy from other agents and clients.

She also explained that she just wants to advise her clients properly. But Ramsey used the moment to demonstrate why this approach to real estate from “get-rich-quick gurus” is dangerous, citing his own experience in the 1980s.

“I started from nothing. I was 22 years old. I got $4 million worth of real estate by the time I was 26,” he said. “Over a million-dollar net worth, meaning I owed $3 million on $4 million [of property]. Not a bad equity position. But the banks got scared and called our notes.”

Trending: The ‘ChatGPT of Marketing’ Just Opened a $0.81/Share Round — 10,000+ Investors Are Already In

He continued, “I had 120 days to come up with a million two, and it was all in real estate and I had no cash because I believed in leverage.”

Ramsey eventually filed for bankruptcy. He called the borrow-to-invest mindset the same “get rich quick” logic that burned him decades ago. “They did not get rich doing this crap,” he said. “No one makes it a decade doing this crap. It’s crap. Don’t do it. Was that unclear?”

Ramsey pointed to former real estate guru Robert Allen, who taught people how to buy property with no money down in the 1980s. Ramsey said he followed that advice and joined one of Allen’s investment clubs. According to him, out of the 130 people who joined Allen’s investment club, only about six still owned real estate three decades later. Those few had paid off their properties and avoided debt. The rest went broke. Even Allen himself eventually filed for bankruptcy. “The whole thing caught up and took him out too,” Ramsey said.”